In 2018, Professor David Harvey, the human geographer and the eminent scholar of Marx’s works and their modern relevance, wrote a short paper entitled “Marx’s refusal of the labour theory of value.” In this paper, Harvey presents a series of theoretical confusions. The dual nature of value in a commodity is ignored by him. So Marx’s theory of crisis (based on insufficient surplus value) is replaced with insufficient use values for workers as consumers. The class struggle becomes not workers versus capitalists, but consumers versus capitalists or taxpayers versus governments. This is confusing to a class analysis and strategy for the working-class struggle.

Professor David Harvey (DH), the human geographer, is probably the most eminent Marxist scholar alive today with a host of books, papers and educational videos to his name on Marxist economic theory. [1] [2] In April 2018, he circulated a short paper expressing succinctly his view of Marx’s value theory that he outlined more expansively in his latest book, Marx, Capital and the Madness of Economic Reason (Harvey, 2017). I replied to this paper. (Roberts 2018)

In the paper, DH argues that Marx did not have a “labour” theory of value at all (Harvey, 2018a). Instead, Marx argued that value was a reflection of labour embodied in a commodity which is only created/revealed in exchange in the market. As DH puts it: “if there is no market, there is no value.” If this is correct, then it is through the realization of value as expressed in money that value emerges, not in the production process as such.

DH then goes on to argue that if wages are forced down to the minimum or even to nothing, then there will be no market for commodities and thus no value and that this is the “real root of capitalist crises.” So it follows that a policy for capital to avoid crises would be by “raising wages to ensure ‘rational consumption’ from the standpoint of capital and colonizing everyday life as a field for consumerism.”

DH points out that this interpretation of value theory “is far beyond what Ricardo had in mind and equally far away from that conception of value usually attributed to Marx.” I can agree that it certainly is. But is DH right in his interpretation of Marx’s value theory and, even if he is, does such interpretation have any empirical validity? I would answer no to both these questions.

DH starts by saying that “It is widely believed that Marx adapted the labour theory of value from Ricardo as a founding concept for his studies of capital accumulation.” Most Marxist economists are aware of the distinction between Marx’s value theory and Ricardo’s. But the difference is not what DH says it is, namely, Ricardo had a “labour theory of value” and Marx did not. The difference is that Ricardo had a theory of (use-) value based on “concrete labour” (physical amounts of labour) measured in labour time, while Marx’s law of value was based on “abstract labour” (i.e. value measured in labour time when “socially” tested on the market).

Under capitalism, human labour power itself is a commodity to be sold on the market. Indeed, this is a key characteristic of the capitalist mode of production where the majority has no means of production and must therefore sell their labour power to the owners of the means of production. So, just as with other commodities, labour has a dual character. On the one hand, it is useful labour, that is, expenditure of human labour in a concrete form and for a specific purpose to create use values. On the other hand, it is abstract labour, that is, expenditure of human “labour power” without specific characteristics, which creates the value of the commodity in which it is represented. Marx made the distinction between labour and labour power, a distinction that is crucial for the understanding of the source of profit.

For any given time period, the worker produces more value than the wage equivalent paid by the owner of capital for the use of that labour power. This difference Marx calls “unpaid labour” or surplus value. Marx’s value theory of abstract labour exposes the exploitative nature of the capitalist mode of production, which neither Ricardo’s nor Adam Smith’s labour theory of value does. This was the great advance in Marx’s law of value over classical political economy.

DH mentions just once (and in passing) this vital discovery of Marx (i.e. abstract labour) that distinguishes Marx’s law from the classical labour theory of value. And that is because DH wishes to press on to his interpretation of Marx’s theory as one where value is created/realized only in exchange, and not in the process of production using labour power.

But the value of a commodity is the labour contained in it and expended during the production process before it gets to market. Value is expended physical and mental human labour, which is then abstracted by the social process of production for the market. Value is not a creature of money — on the contrary. Money is the representation or exchange value of labour expended, not vice versa. I think Marx is clear on this crucial point. He says in Capital Volume One: “The value of a commodity is expressed in its price before it enters into circulation, and it is therefore a pre-condition of circulation, not its result.” [3]

In a subsequent reply to this critique, DH denies that he considers value is only created in exchange or circulation:

Let me be clear. Value is always created in the act of production. But it is realized in the moment of market exchange. I therefore think of value in terms of what Marx calls “the contradictory unity of production and realization.” Value cannot be produced through market exchange. But it cannot be realized outside of market exchange. Marx is clear enough about that. [4]

DH goes on:

But — and here this may be my peculiar way of looking at it — I take the value created in production to be only a “potential” value until it is realized. An alternative way would be to say that the value is produced but then the value is lost if there is no demand for it in the market.

In my view, DH is engaging in a degree of sophistry here as this response differs from his initial paper. In contrast, professor Murray Smith, in his book Invisible Leviathan (Smith, 2019: 115), provides a concise explanation of the difference between Marx’s law of value and the kind of interpretation with which DH is associating himself. To try and argue that that value is created

not in production but “at the articulation of production and circulation” [is] a notion replete with circular reasoning and requiring the most robust of mental gymnastics to entertain. […] The problem with this approach is that if one accepts that “abstract associated labour has no substantial existence apart from the value form, money,” then commodity values appear to be severed entirely from any determination in the conditions of their production, and the way is paved for an effective identification of value and price.

There is a reason behind DH’s interpretation. If value is created only at the moment of exchange for money and “money rules,” then it will be (effective) demand that will decide whether capitalism smoothly accumulates without recurring crises. To show this, DH uses some of the graphic examples provided by Marx in Chapter 25 of Volume One. DH emphasizes that capitalist accumulation aims to minimize the value of labour power — even to the point of pauperism. DH concludes that

If this is a typical outcome of the operation of the capitalist law of value accumulation, then there is a deep contradiction between deteriorating conditions of social reproduction and capital’s need to perpetually expand the market. As Marx notes in Volume 2 of Capital, the real root of capitalist crises lies in the suppression of wages and the reduction of the mass of the population to the status of penniless paupers.

There are several points here. First, Chapter 25 in Marx’s Capital Volume One, entitled “The general law of capitalist accumulation,” does not just refer to the pauperization of the working class. DH leaves out a very important aspect of that “general law”: the tendency for the organic composition of capital to rise. This is what drives up relative surplus value. It is also a key factor in the tendency of the rate of profit to fall (developed in Volume 3 of Capital), “the most important law of political economy” according to Marx (Marx, 1971: 748), which lays the basis for Marx’s theory of crises. DH ignores this.

DH goes further in his interpretation:

Value depends on the existence of wants, needs and desires, backed by ability to pay in a population of consumers. […] It also means that the diminution of wages to almost nothing will be counterproductive to the realization of value and surplus value in the market. Raising wages to ensure “rational consumption” from the standpoint of capital and colonizing everyday life as a field for consumerism are crucial for the value theory.

Thus, DH argues that capitalism goes into crises because wages are suppressed; and raising wages, ensuring “rational consumption,” would provide the “ability to pay” and so end the crisis.

In his subsequent reply to my critique, DH says:

It was Marx, not me, who said “the real root of crises” lies in the diminished purchasing power of the working classes and if I cite Marx on that point it is because it is a neat antidote to all those who endlessly cite the falling rate of profit.

This is of course not the first time that DH has been dismissive of the falling rate of profit theory (see Harvey, 2006). But this underconsumptionist interpretation of Marx’s crisis theory had been firmly dismissed by Marx himself in the famous note in the same Volume 2 that DH refers to:

It is sheer tautology to say that crises are caused by the scarcity of effective consumption. […] That commodities are unsaleable means only that no effective purchasers have been found for them. But if one were to attempt to give this tautology the semblance of a profounder justification by saying that the working-class receives too small a portion of its own product and the evil would be remedied as soon as it receives a larger share of it and its wages increase in consequence, one could only remark that crises are always prepared by precisely a period in which wages rise generally and the working-class actually gets a larger share of that part of the annual product which is intended for consumption. From the point of view of these advocates of sound and “simple” (!) common sense, such a period should rather remove the crisis. [5]

In my view, Marx rejected both the law of value as DH interprets it and the conclusion that crises are caused by an inability to pay for the “wants, need and desires” of people. But one might argue that Marx was wrong and DH was right on the cause of crises. Empirical evidence does not support DH, however.

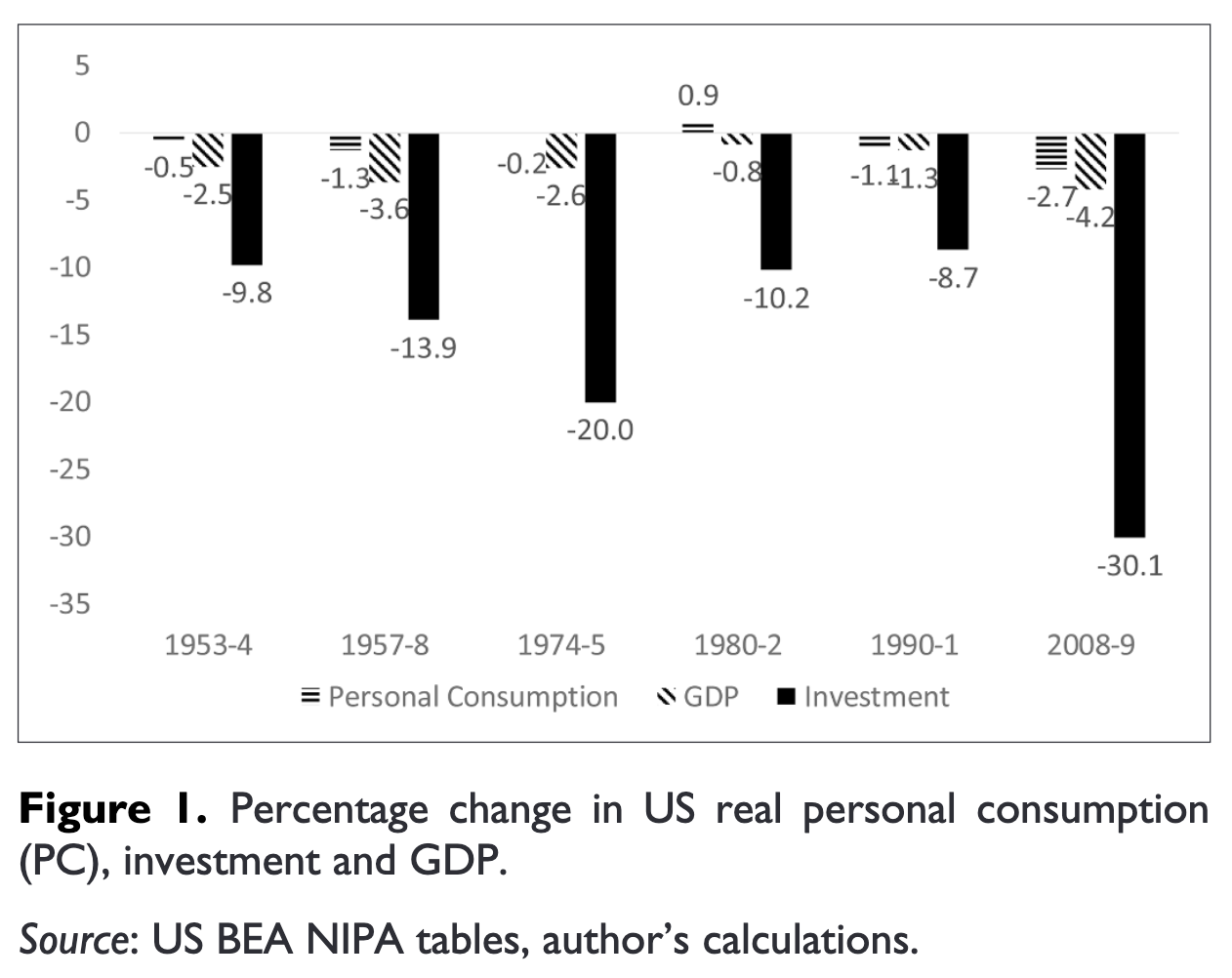

Let me cite just three facts. The first is that workers’ consumption is not the largest sector of ‘demand’ in a capitalist economy; rather, it is productive capital consumption. In the United States, consumption would seem to constitute 70% of GDP. However, if you look at ‘gross product’ which includes all the intermediate value-added products not counted in GDP, then consumption is only 36% of the total product; the rest constitutes demand from capital for parts, materials, intermediate goods and services. It is investment by capitalists that is the swing factor and driver of demand, not consumption by workers.

In his reply to my critique, DH rejects the relevance of the size of capitalist purchases of capitalist production.

Suppose for some reason the final consumers cannot pay or get fed up with autos. Then all the accumulated value is lost (devalued). In practice, as Marx observed, the chain of payments might take a while to work through but when it does then all value production in the chain disappears. [6]

Having denied that he has an underconsumption theory of crises, DH then offers one. Of course, if consumers stop buying autos, then the profits of the auto manufacturers would fall or disappear. But this scenario implies that “consumers” are some external force of “effective demand” separate from being workers in employment. Consumption falls when wages stagnate and/or unemployment rises. But that happens only when capitalists stop investing and employing labour. And that happens when profits fall. The sequence is not from consumption to investment but vice versa.

This is shown in the second fact. If we analyse the changes in investment and consumption prior to each recession or slump in the post-war US economy, we find that consumption demand has played little or no leading role in provoking a slump. In the six recessions since 1953, personal consumption fell less than GDP or investment on every occasion and does not fall at all in 1980-1982 (Figure 1). Investment fell by 8%-30% on every occasion.

The third fact relates directly to wages and DH’s claim that raising them would help capital. Carchedi (2018) finds that of the 12 post-WWII crises, 11 have been preceded by rising wages and only one by falling wages (the 1991 crisis). This confirms Marx’s view in the note in Volume 2 above.

I conclude from DH’s short paper that he aims to establish an argument that class struggle is no longer centred or decided between labour and capital at the point of production of surplus value. Instead in “modern” capitalism, it is to be found in other phases of the “circuit of capital” that he presents in his latest book and in various presentations globally. For DH, it is at the moment of realization (of rents, mortgages, price gouging by pharma firms, etc.) or in the distribution of income (its allocation through taxation, public services, etc.) that the “hotspots” of class struggle are now centred. The class struggle in production is now less important (even non-existent).

In his reply to my critique, DH says:

This does not mean I downplay, deny or refute all the work that has been done on the labour process and the importance of the class struggles that have occurred and continue to occur in the sphere of production. But these struggles have to be put in relation to struggles over realization, distribution (e.g. rental extractions, debt foreclosures), social reproduction, the management of the metabolic relation to nature and the free gifts of culture and nature.

In this reply, I think he does just that: “downplay” the importance of the class struggle at the point of production in favour of his other “hotspots.”

In my view, to support his view of modern class struggle, DH presents a series of theoretical confusions in this paper. First, Marx did not have a labour theory of value. Second, value is only created in exchange (in realisation). Third, the rate of profit (or even profit alone) is irrelevant to crises: what matters is the driving down of the value of labour power to the minimum (or even zero!) so that workers are unable to meet their “wants, desires, etc.” Despite his denials, in my view, this becomes a crude underconsumption theory — cruder even than that of Keynes.

Marx’s theory of crisis (based on insufficient surplus value creation) is replaced, in the hands of DH, with insufficient use values for workers as consumers. Overaccumulation of capital is effectively replaced by underconsumption of goods and services. The class struggle becomes one not between workers and capitalists, but one between consumers and capitalists, or between taxpayers and governments. This is not Marx’s view. But more importantly, the whole approach is confusing to a class analysis and to developing a strategy for the working-class struggle.

References

- Carchedi G (2018) “The old is dying but the new cannot be born: on the exhaustion of western capitalism.” In: Carchedi G and Roberts M (eds) World in Crisis. Chicago: Haymarket Books.

- Harvey D (2006) Limits to Capital. London: Verso.

- Harvey D (2017) Marx, Capital and the Madness of Economic Reason. Oxford: Oxford University Press.

- Harvey D (2018a) “Marx’s refusal of the labour theory of value.” [web]

- Harvey D (2018b) “The misunderstandings of Michael Roberts.” [web]

- Marx K (1971) Grundrisse: the foundations of the critique of political economy, McLellan D ed. London: MacMillan.

- Marx K (1977) Capital Volume One. New York: Vintage Books.

- Marx K (1978) Capital Volume Two. New York: Vintage Books.

- Roberts M (2018) “Marx’s law of value: a debate between David Harvey and Michael Roberts.” [web]

- Smith M (2019) Invisible Leviathan: Marx’s Law of Value in the Twilight of Capitalism. Historical Materialism, Haymarket.