A great deal has been written lately about the potential decline of the U.S. dollar’s dominance in international trade and the rise of alternative trade mechanisms involving other currencies such as the yuan. To better contextualize these events, it’s useful to revisit some major events from the 1990s that hinged upon and shed light on the dollar’s dominance of financial institutions and world trade.

Before American hegemony international trade relations were often conducted without recourse to the dollar. For example, trade between India and the Soviet Union was carried out in terms of mechanisms like “rupee payment arrangements”:

[B]ilateral trade was denoted in terms of Indian rupees (or Russian roubles whose exchange rate against the rupee was fixed); and the balances in trade that got built up in favour of one country against the other were not immediately settled. Further, even into the settlement of these balances, the dollar did not enter; they got carried over and were bilaterally settled over a period of time. [1]

The fall of the Soviet Union in 1991 made inevitable what had been brewing for the decades before it with the Bretton Woods Conference [2] and the ascendance of the United States as a global superpower: alternative systems would have to be abandoned; every country would have to integrate with the American-engineered financial “world-system” or be left out in the cold.

One typical argument went something like this: The American economy was so powerful, the U.S. dollar so stable, and the U.S. so scrupulous and fair when it came to upholding the sanctity of contracts, that instead of doing complicated accounting to enable trade with each other, countries could much more simply settle all transactions immediately in U.S. dollars, and spare themselves having to trust the stability of their counterparty’s currency. In this way the U.S. handles the financial bean-counting freeing up deal-makers to focus on real business.

However, actually linking up one’s domestic currency to the dollar isn’t a trivial matter. The “real value” of a financial object isn’t decreed anywhere — money isn’t an object, it’s a fluid signifier for a relationship between entities. [3] Therefore, the exchange rate between any two financial objects (say, dollars and pounds) is every bit as fluid.

One natural choice to relate two currencies is to just let the exchange rate “float.” In this scenario the exchange rate is not decided-upon but rather reported: the result of aggregating financial transactions over a given period. This reported value acts essentially a form of guidance arrived at through the monitoring of free competition, and thus largely obviates the reason for existence of black markets (which thrive when the “real” exchange rate is different than the official exchange rate). However, it also introduces some instability: If a foreign institution invests in a country, and then wants to back out a month later, could they end up being losers due to a depreciating currency? Could the building of a large factory run into unforeseen shortages due to a rapidly appreciating currency? Several financial instruments have been invented to allow investors to hedge and manage the risk of currency appreciation and depreciation, but here we will focus on one particularly obvious tool: the peg.

Countries can, as a kind of service to investors, guarantee an exchange rate, regardless of the underlying vagaries of the real economy. Central banks can promise investors that regardless of any fluctuations in the exchange rate — at any rate expected to be minor — they can be made whole out of their own treasuries. The “dollar peg,” making such a promise in relation to the U.S. dollar, entails a state actor essentially absorbing financial risk for the sake of, among other things, making investments into their economy a much more stable and therefore attractive prospect. It’s a gambit: they may have to make some people even from time to time, but if investment leads to overall growth the country comes out ahead. So long as countries are large and individual investors small, it’s a very viable option, and so many countries adopted this strategy. These are the circumstances which set the stage for the invention of the “speculative attack.”

In brief, the attack consists in identifying a currency peg and studying it to see how expensive it is to maintain. If the peg is expensive and the government maintaining it does not have sufficient resources to resist pressure, then the peg is vulnerable to an attack. One of the earliest such examples is how George Soros “Broke the Bank of England” in 1992: he identified that the British pound’s peg to the German Deutschmark was expensive due to Britain’s much higher inflation rate than Germany. By short-selling the pound, [4] Soros was able to increase the costs of maintaining the peg to the British government into the billions as they were forced to artificially buoy the value of the pound to maintain the peg. Very quickly the British government realized they could not afford this and withdrew, causing the pound’s exchange value to float again. As a result, the value of the pound plummeted, and Soros cashed out $1 billion in profits (an incredible sum in 1992 dollars). [5]

The Bank of England, however, was just an opening shot. Since speculative attacks need to be carried out by individual investors against a state actor (a state doing it would probably be considered an act of war), in most cases developed countries aren’t really vulnerable to it — individual investors can’t usually buy enough of the national currency of a developed country to trigger a national crisis (special situations such as Soros and Great Britain notwithstanding). Therefore, after the attack was studied and refined, viable targets were sought elsewhere: in the people of small and vulnerable developing countries, against whose states a handful of private Western investors could stand toe-to-toe.

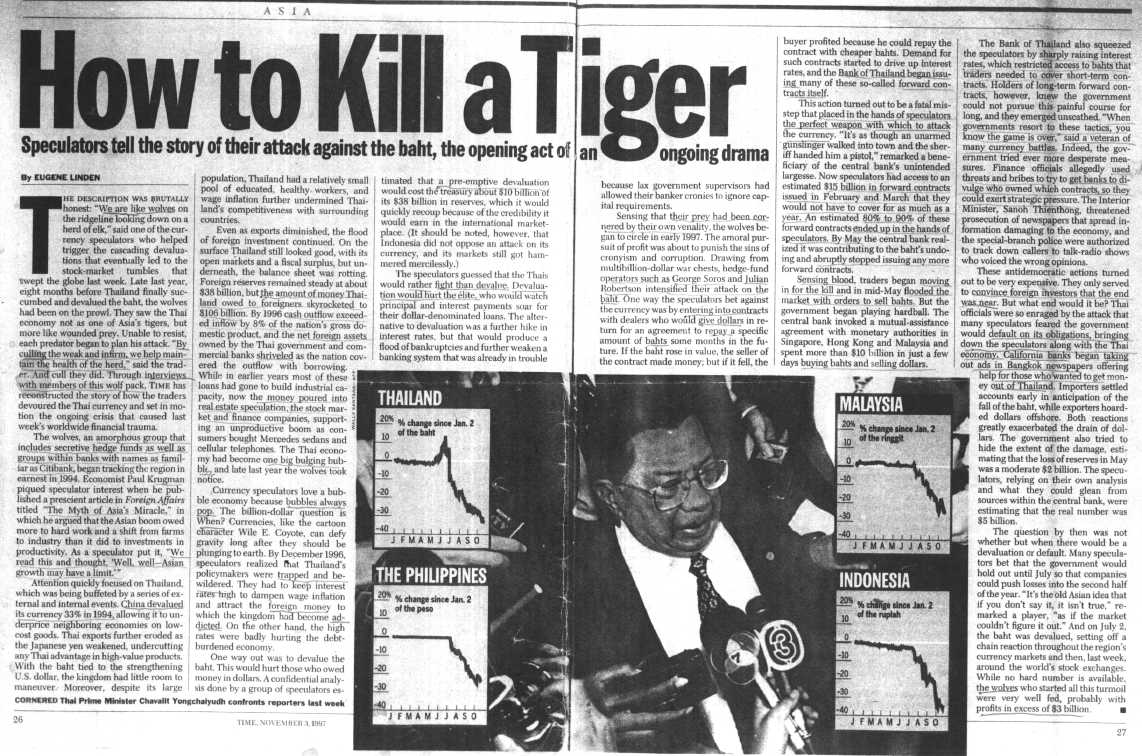

In the 1996-1998 period the attacks came for what had recently been dubbed the “Asian Tigers.” [6] These countries had been attracting foreign investment in order to become manufacturing hubs, and to do so they had offered up dollar pegs. Private Western investors went one by one through Thailand, Indonesia, South Korea, Malaysia, the Philippines, etc. betting that these governments could not maintain their dollar pegs, and would have to float and devalue their local currencies. This came to be euphemistically known, in quintessential passive voice, as the “1997 Asian Financial Crisis.” [7] In Thailand’s case, the government used up 90% of its foreign currency reserves trying to defend its dollar peg before giving up and floating the baht, collapsing its value by more than 50% for a period. In order to “save” the Thai economy — by providing money to save its currency — the International Monetary Fund (IMF) intervened, taking the opportunity to impose a far-reaching “structural adjustment package” (SAP) which demanded massive austerity and high interest rates. These measures destroyed Thailand’s industry and collapsed the Thai stock market, resulting in nationwide mass layoffs and de-urbanization, as workers either returned to the countryside or were forced into poverty. Being first victims of Euroamerican investors, and then of the IMF, these nations were lectured by U.S. Secretary of State Madeleine Albright on “the building blocks of a true democracy” and how to avoid “drugs, prostitution or crime.” [8]

After hobbling most of the “Asian Tigers,” with the Central Bank of Taiwan capitulating their peg to investors in late 1997, speculators set their sights on the crown jewel of the region: Hong Kong. Hong Kong was a bustling financial hub, “the gateway between the East and West,” one of the highest banking concentrations in the world, etc. Beneath the splendor, however, it seemed vulnerable due to many similarities to Thailand, with a growing real estate and stock bubble. The target was the Hong Kong dollar’s peg to the U.S. dollar, longer-standing than most — it was established in 1983 to bring stability in the context of volatility in the British pound and handover talks with China. Speculators revved up operations as they had before against Thailand, Malaysia, and Taiwan, awaiting the juiciest of payouts. By August 1998, the Hang Seng Index (Hong Kong’s stock market) had fallen more than 60% from its 1997 highs. Not only investors but also the general public began to worry, the contagion could even spread to mainland China and lead to a fall in the value of the yuan as well.

Then something quite unexpected happened — the government of China, despite having a far smaller war chest of foreign reserves than it does today, [9] announced its full support for the defense of Hong Kong from speculators. Premier Zhu Rongji told the markets that China would defend Hong Kong from the financial crisis “at all costs,” and even confronted George Soros directly at a conference, telling him that “China will not devalue the yuan and will assume the historical responsibility of stabilizing the Asian financial environment.” [10]

The Hong Kong government, with the backing of the mainland, plowed billions into the markets, buying stocks, futures, and the HK dollar in record volumes, committing a significant chunk of their foreign reserves, and were able to defend the peg and support their markets. In the words of the New York Times: “In a climax to an unprecedented two-week-long direct intervention in the stock market, Hong Kong’s government spent at least $8 billion today on a buying spree to prop up shares and foil speculators it accuses of manipulating its market.” [11]

By the end of August, the crisis had passed, and speculators including Soros had to walk away with major losses. The outrage was enormous, especially from Western economists. The whole Western financial world, which had been celebrating speculative attacks as harsh lessons in financial prudence at the hands of savvy Euroamerican bankers, was aghast that a large economy would dare step in on behalf of another smaller one in an unpredictably solidary way — certainly a lesson delivered in kind. Some, including Soros himself, would eventually come to agree that China made the right move; [12] others never relented on calling them “currency manipulators.” The reclusive and supposedly economically-naive giant of Marxist China turned out to understand finance quite well, especially regarding its power in the hands of a far-sighted political sovereign.

There’s many lessons one can take from this story, but here’s one: Just as peace-loving Marxists had to learn to use guns to defend themselves despite any dislike of guns, finance-critical Marxists should learn to defend themselves with markets despite any dislike of markets. A 21st century Marxism that balks at speaking usefully and knowingly about strategies in the realm of finance purchases its purity at the dear price of its relevance.

[1] Prabhat Patnaik, “Sanctions within a Regime of Neo-Liberalism” (2022). [web]

[2] A notorious 1944 conference where representatives from Western countries united to lay the foundation for a post-war “economic order,” founding institutions such as the International Monetary Fund (IMF) and the World Bank. [web]

[3] Roderic Day, “Commodity Fetishism” (2023). [web]

[4] The classic way to obtain profit is colloquially summed up as “buy low, sell high”, and it represents a kind of faith in a commodity. A “short”, to be very simple about it, is a semi-sophisticated way to express the opposite pessimistic opinion: a bet can be made, over an allegedly over-valued commodity, to “sell high, buy low”, producing financial operations in the present tethered to a reverse operation in the future.

[5] “In 1992, Soros became famous as ‘the man who broke the bank of England,’ as his bets against sterling contributed to Black Wednesday. The British government had to withdraw the pound from the exchange rate mechanism, and Soros pocketed around $1bn, for which he was vilified by the tabloids. He has expressed no remorse for making a fortune out of currency speculation, shrugging that others would do the same if he didn’t.” — Shaun Walker, “George Soros: ‘Brexit hurts both sides — my money was used to educate the British public’” (2019-11-02), The Guardian. [web]

[6] “Speculative Attacks Force East Asian Countries to Let their Currencies Float, Resulting in the Asian Financial Crisis of 1997” (2019-06-12), Goldman Sachs. [web]

[7] A. B. Abrams, “Economic War on Asia: South Korea and the Asian Tigers” (2019). [web]

[8] U.S. Department of State, “Secretary of State Madeleine K. Albright and Thai Foreign Minister Surin Pitsuwan” (4 March 1999). [web]

[9] About US$150-160 billion compared to US$3.3 trillion today: “The country’s foreign exchange reserves, despite recent outflows, are still the world’s largest at US$3.3 trillion, 20 times the level of 18 years ago.” SCMP (28 January 2016). [web]

[10] South China Morning Post, “Export equation adds up to yuan devaluation” (11 December 1997). [web]

[11] New York Times, “The Market Turmoil: It’s a Dark and Stormy Night… and Here’s Hong Kong Trying to Line the Clouds With Silver” (29 August 1998). [web]

[12] “A decade later, Greenspan wrote that the HKSAR had made the right call. Soros himself also admitted in 2001 that the authorities did ‘a very good job when they intervened to arrest the collapse of the Hong Kong market.’” — CGTN, “How Hong Kong survived the 1998 financial crisis” (14 August 2019). [web]